car lease tax deduction

Include these amounts on. New York Excess Wear Tear Statutes.

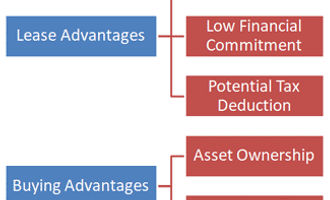

Which Is Better For Taxes Leasing Or Buying A Car Bankrate

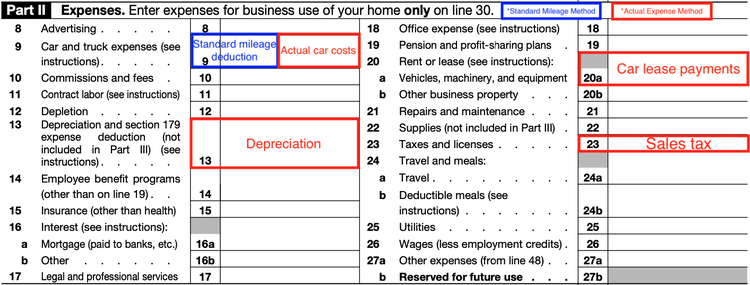

Using actual expenses These include.

. There are two methods for figuring car expenses. In certain cases the deduction for the cost of hiring a car which can be made in calculating the profits of a trade is restricted. A Upon the scheduled termination.

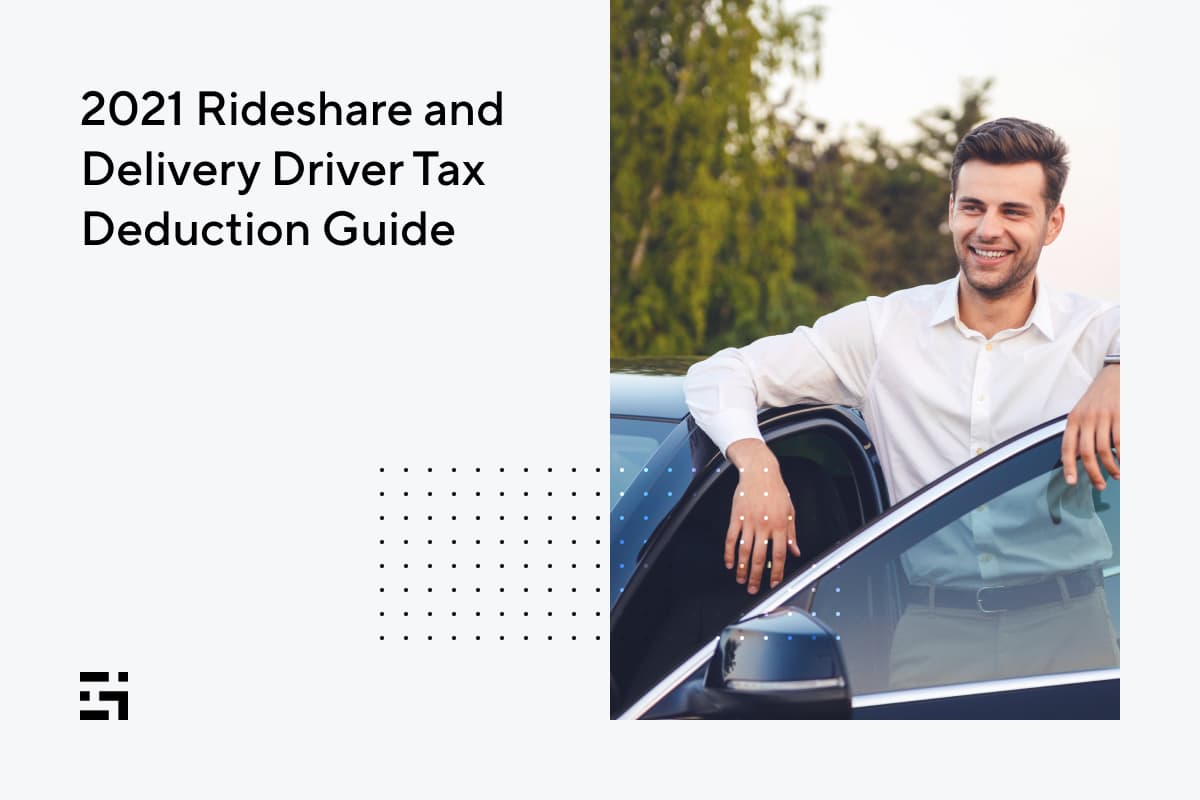

The rate in 2019 was 058 and it sits at 0575 in 2020. You can generally figure the amount of your. However if you use the car for both business and personal purposes you may deduct only the cost of its business use.

Assessment of excess wear and damage to the vehicle 1. In order to make tax deductions on a leased car you need to submit a final VAT return form to HMRC which can be done either online or via compatible accounting software. You can deduct costs you incur to lease a motor vehicle you use to earn income.

A leased car driven 9000 miles for business equates to a 5175 deduction. Businesses considering a vehicle purchase andor lease may want to set. Lets continue with the previous example.

This is called a SALT deduction. As GMs comprehensive list shows possible tax benefits exist for a wide range of business vehicles. If the sale is made by a motor vehicle or trailer dealer or lessor who is registered the sales tax rate is 625.

You can claim a maximum of 5000 business kilometres per car. NY Code - Section 343. Line 9819 for farming.

When paying a sales tax on your leased car you can take a tax deduction from the federal income tax. Deducting sales tax on a car lease The sales tax included in your lease payment also counts as business expense. See reviews photos directions phone numbers and more for Car Donation Tax Deduction locations in Medford NY.

Car lease payments are considered a qualifying vehicle tax deduction according to the IRS. 66 cents per kilometre for the 201718 201617 and 201516. With that being said there.

Tax deductions on leased cars. Its often included in the monthly cost of the lease and it. Are car lease payments tax deductible.

Line 9281 for business and professional expenses. The use tax applies to all other types of transfers of title or. A 15 restriction applies to cars with CO2 emissions of more than.

See reviews photos directions phone numbers and more for Car Donation Tax Deduction locations in. With a car lease you can claim your monthly payments as a business expense meaning you can reclaim a percentage of VAT depending on the ratio of personalbusiness. To calculate your deduction multiply the number of.

LAW 343. The deduction is based on the portion of mileage used for business.

![]()

Car Leasing Guide How To Lease A Vehicle Kelley Blue Book

2021 Rideshare And Delivery Driver Tax Deduction Guide Gridwise

Writing Off A Car Ultimate Guide To Vehicle Expenses

Do You Need A Certain Credit Score To Lease A Car Student Loan Hero

Maserati Section 179 Deduction For Vehicles Joe Rizza Maserati

17 Big Tax Deductions Write Offs For Businesses Bench Accounting

Five Myths About Leasing A Car Kiplinger

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

Giving Employees A Company Car Here S The Tax Implications Wegner Cpas

Is It Better To Buy Or Lease A Car Taxact Blog

Tax Benefits Of Leasing A Car For Business Carparison

Rules For Business Vehicle Tax Deductions Podcast 131 White Coat Investor

How To Take A Tax Deduction For The Business Use Of Your Car

Car Leasing And Taxes Points To Ponder Credit Karma

Can I Claim A Leased Vehicle On My Tax Return

The Best Auto Deduction Strategies For Business Owners Mark J Kohler

:max_bytes(150000):strip_icc()/GettyImages-1272562238-9909596567584282b0472d298f3c4c38.jpg)